[ad_1]

The worldwide UGV market is forecasted to show first rate progress over the following decade, though the platforms are much less influential than their ubiquitous aerial cousins. Gordon Arthur experiences.

Uncrewed floor autos (UGV) have been round a very long time, however their considerably restricted use on battlefields has seen them lagging behind uncrewed aerial autos (UAV) when it comes to the limelight and utility.

That is clearly demonstrated within the ongoing Russian invasion of Ukraine. Whereas UAVs just like the Turkish-built Bayraktar TB2 are proving lethal, only a few UGVs could be seen. Russia has been utilizing the T-90-based Prokhod-1 robotic mine clearance system for route clearance in Ukraine, in addition to Kobra and Uran-6 UGVs, though this has tended to be solely in safer rear areas.

Market progress areas

Based on GlobalData, the worldwide uncrewed floor car (UGV) market is valued at $476m in 2022 and can develop at a compound annual progress price (CAGR) of 4.4% to succeed in a worth of $732m by 2032. The cumulative market of the worldwide army UGV market is anticipated to be valued at $6.9bn over the forecast interval.

Over the forecast interval, the demand for army UGVs is anticipated to be witnessed most prominently within the North American and European markets, particularly in international locations such because the US, Russia, France, Germany, and the UK.

The North America area itself, supported by the large-scale investments from the US, is predicted to keep up its main place globally, exhibiting a gradual tempo of progress over the forecast interval with a CAGR of 5.1%.

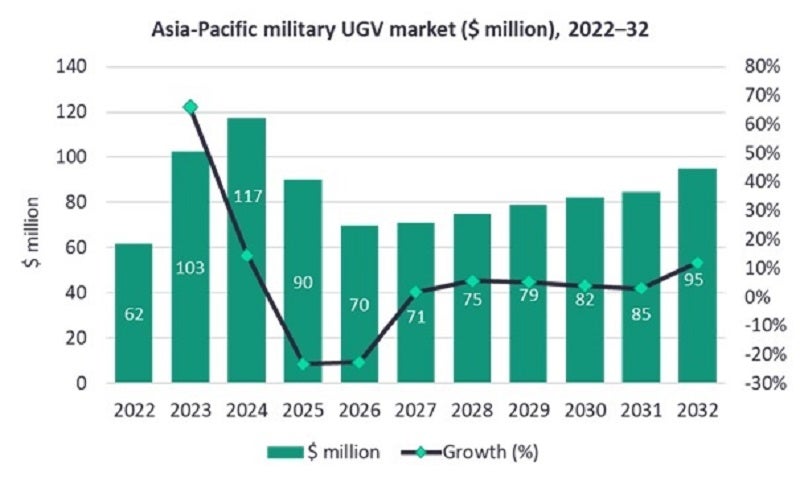

In the meantime, the Asia-Pacific area will maintain the third largest place globally with a CAGR of 4.4% over the forecast interval, primarily pushed by the procurement methods adopted by key economies within the area. Nations resembling China, India, Australia, and South Korea have been growing the deployment of superior UGVs with their armed forces.

Hazard shut

Two major makes use of for UGVs in latest a long time, as illustrated in Ukraine, have been explosive ordnance disposal (EOD) robots and mine-clearing gadgets.

World Defence Expertise requested Kelvin Wong, a Singapore-based impartial defence expertise analyst, about this. He responded: “On the present state of growth, UGVs seem to excel in supportive roles resembling EOD and logistics, the place fixed human interplay isn’t required and the place the mission parameters are extra restricted in scope.”

Certainly, the mantra is that uncrewed methods are perfect for soiled, harmful and dreary work. Mine-clearing is actually harmful, and options resembling Pearson Engineering’s optionally manned Minewolf minefield clearance car exist.

Nevertheless, technical challenges nonetheless have to be overcome earlier than uncrewed detection methods turn out to be extra extensively utilized in mine clearance and counter-improvised explosive machine duties. They have to be capable to search massive areas with minimal false alarms, and with the accuracy of expert operators. Whereas militaries want to deploy nimble multipurpose autos round battlefields, they need to overcome pure and artifical obstacles resembling minefields.

Teledyne FLIR is a serious producer of robotic methods, and in 2021 it obtained a $70m order for almost 600 Centaur medium-sized robots underneath the US Military’s Man Transportable Robotic System Increment II programme, bringing complete deliveries to all 4 US army providers to some 1,900 Centaurs. An extra contract was awarded in mid-2022, highlighting the massive scale of many US programmes.

Teledyne FLIR additionally makes the 166kg Kobra for the US Military’s Frequent Robotic System – Heavy programme. Importantly, robots are rising in autonomy, goal mapping and the power to work as cross-domain methods. For instance, Teledyne FLIR’s R&D has seen an R80D SkyRaider quadrotor UAV flying over an airfield to detect unexploded ordnance, with related knowledge then relayed to a UGV for clearance.

Technical challenges

Wong famous: “UAVs have clearly turn out to be ubiquitous, whereas their land counterparts have not likely moved past these very restricted roles apart from small-scale trials and idea growth.”

So why are UGVs lagging behind their aerial cousins?

Wong defined: “It may very well be on account of a number of ongoing challenges like expertise limitations, but additionally on account of a lack of expertise and belief concerning such autos that possible function in shut proximity to troops. For instance, how does a soldier work together with uncrewed autos – significantly armed varieties – within the warmth of battle?

“Does a specific UGV possess excessive ranges of autonomy in order that they simply perceive easy visible or verbal alerts, or is it capable of react appropriately to unanticipated conditions? Would ‘babysitting’ a UGV additional enhance the cognitive burden on already mentally and bodily taxed operators within the area?”

Wong identified that “many of those questions look like removed from being answered, given the myriad number of trials and idea of operations growth workouts the world over. In distinction, UAVs have been readily utilized in each peacetime and battle throughout this time.”

Aside from the human belief issue, what technological challenges are holding again UGVs? Wong summarised: “Regardless of developments in enabling applied sciences resembling autonomy, machine imaginative and prescient and platform mobility, challenges in impediment avoidance and clearance – significantly in difficult cross-country and forested terrain – nonetheless stay. That is particularly so for land fight operations that demand uninterrupted and uncompromised functionality lest it end in mission failure and danger to troopers’ lives, and subsequently units a excessive bar for reliability.

“Furthermore, many UGVs are successfully tele-operated regardless of being marketed as ‘extremely autonomous’, on condition that an operator is usually controlling it to numerous levels. Consequently, the lag between an operator – and his/her expertise (or lack thereof) – and the car may end in unfavourable outcomes in high-stress or difficult tactical conditions.”

Wong listed one other impediment too. “The fielding of UGVs probably provides to the bandwidth stress of recent fight operations, necessitating a wide-area safe community earlier than these autos can successfully be commanded. As such, there’s all the time an actual danger of communications/knowledge hyperlink failure between the operator and car, particularly in cluttered terrain or in electromagnetically challenged environments (which accurately describes the fashionable battlefield).”

Programmes to observe

One UGV that’s making waves stems from Estonia. Wong said: “Regardless of being a relatively smaller nation, Estonia has clearly captured important mindshare globally with its tracked THeMIS, which mixes a excessive diploma of modularity with a sturdy tracked platform, in addition to its combat-oriented larger brother the Kind X.”

This 12 months, its maker Milrem Robotics delivered one THeMIS to a Ukrainian charity organisation for casevac and resupply missions. So far, 16 international locations have acquired the optionally armed THeMIS, half of that are NATO international locations. It additionally kinds the muse of the Built-in Modular Unmanned Floor System (iMUGS) scalable UGV household being developed by a consortium of European firms.

Asia-Pacific is a hotbed of UGV growth too. As with its bewildering UAV business, China recurrently rolls out fascinating UGV ideas, one instance that Wong highlighted being the AAV7-sized Marine Lizard amphibious UGV. Nevertheless, aside from ideas routinely showcased at exhibitions – like Norinco’s 12t VU-T10 tracked fight UGV armed with a 30mm cannon, coaxial machine gun and twin antitank missiles that appeared in November’s Zhuhai Air Present – UGVs in Chinese language army service stay extra elusive.

Wong declared South Korea as one other nation to observe. Hanwha Protection’s 2t Arion-SMET was not too long ago chosen for US Military trials. This 6×6 UGV, powered by lithium-ion batteries and with 550kg payload capability, is designed to assist platoon-level operations.

Hanwha Protection additionally developed the 6×6 Unmanned Surveillance Car. Dronebot Warrior, a specialist Republic of Korea Military unit devoted to uncrewed applied sciences, accomplished area trials of the 2t UGV in February 2021.

Regardless of developments in enabling applied sciences resembling autonomy, machine imaginative and prescient and platform mobility, challenges in impediment avoidance and clearance – significantly in difficult cross-country and forested terrain – nonetheless stay

Kelvin Wong, defence analyst

In the meantime, arch-rival Hyundai Rotem was awarded a $3.6m contract in November 2020 to construct two 6×6 Multipurpose Unmanned Floor Automobiles (MUGV) for evaluations. These MUGVs, primarily based on the HR-Sherpa, have been handed over in July 2021 for six months of testing.

The Australian Military has fascinating programmes too, with BAE Methods Australia changing 20 M113AS4 armoured personnel carriers into optionally crewed fight autos. These autos function autonomously however with a human within the decision-making loop, their purpose being efficiency of reconnaissance and logistics missions.

One other Australian venture is seeing modification of military MAN 4×4 vans to allow them to journey in leader-follower convoys. The thought is to maximise the operational effectivity of the truck fleet by eradicating operators, drivers and commanders from following autos. On this manner, the human workforce can concentrate on harder or significant duties.

The Atlantic pillars

The UK has put its experimental eggs within the Robotic Platoon Automobiles basket. The UK procured 4 Mission Grasp 8×8 autos from Rheinmetall Canada in 2020, one other 4 in 2021 and, underneath the ultimate Spiral 3 section, an extra seven Mission Grasp SP car in January 2022 (4 in ISTAR configuration and three in cargo guise).

The US Military has a number of foci – the Optionally Manned Combating Car (OMFV), Robotic Fight Car (RCV) and Small Multipurpose Gear Transport (S-MET). The previous might be an infantry combating car to switch the M2/M3 Bradley.

Following a draft RfP issued in December 2020, the 5 OMFV bidders Basic Dynamics Land Methods (GDLS), BAE Methods, American Rheinmetall Protection, Oshkosh Protection and Level Clean Enterprises have been awarded 15-month idea design contracts. Three might be chosen in mid-2023 to proceed with prototypes.

Relating to the RCV programme, three UGV variants are envisaged to offer situational consciousness and ship lethality while lowering danger to formations. Relations embrace the Gentle (RCV-L), Medium (RCV-M) and Heavy.

The US Military will launch an open competitors for the RCV-L in FY2023, with $698m put aside over the approaching 5 years. QinetiQ North America was chosen in 2020 to offer a surrogate prototype, because the US Military conducts three spiral take a look at cycles until FY2025. RCV-L distributors will then be chosen to offer full-system prototypes.

In the meantime, a Textron, Howe & Howe and FLIR staff offered an RCV-M prototype, the tracked Ripsaw M5 outfitted with a 30mm cannon. Based mostly on its M5 expertise, Textron Methods can be aiming its Ripsaw M3 at RCV-L.

The US Military is moreover pursuing the S-MET for dismounted troopers and small models. GDLS, following a 2020 contract, not too long ago delivered an preliminary tranche of 16 of 624 S-MET autos. This 8×8 “robotic mule” has a hybrid-electric powertrain. Below S-MET Increment 2, the military might require 2,200 autos with varied modular mission payloads.

Work to be performed

The aforementioned US programmes underscore the place UGVs are presently at, when it comes to marketability and system functionality. They promise a lot and 1000’s may ultimately be utilized in a number of functions.

Developments in applied sciences resembling synthetic intelligence, machine studying, and superior navigation methods helps to drive progress within the UGV market, enabling ‘good’ platforms that may be capable to undertake a better number of operations. Nevertheless, the expertise, human belief and ideas of operation nonetheless want appreciable honing. The UGV sector and the platforms have come a great distance, however there’s nonetheless a ways left to journey earlier than each attain a market and functionality vacation spot as influential as their airborne counterparts.

[ad_2]

Supply hyperlink