[ad_1]

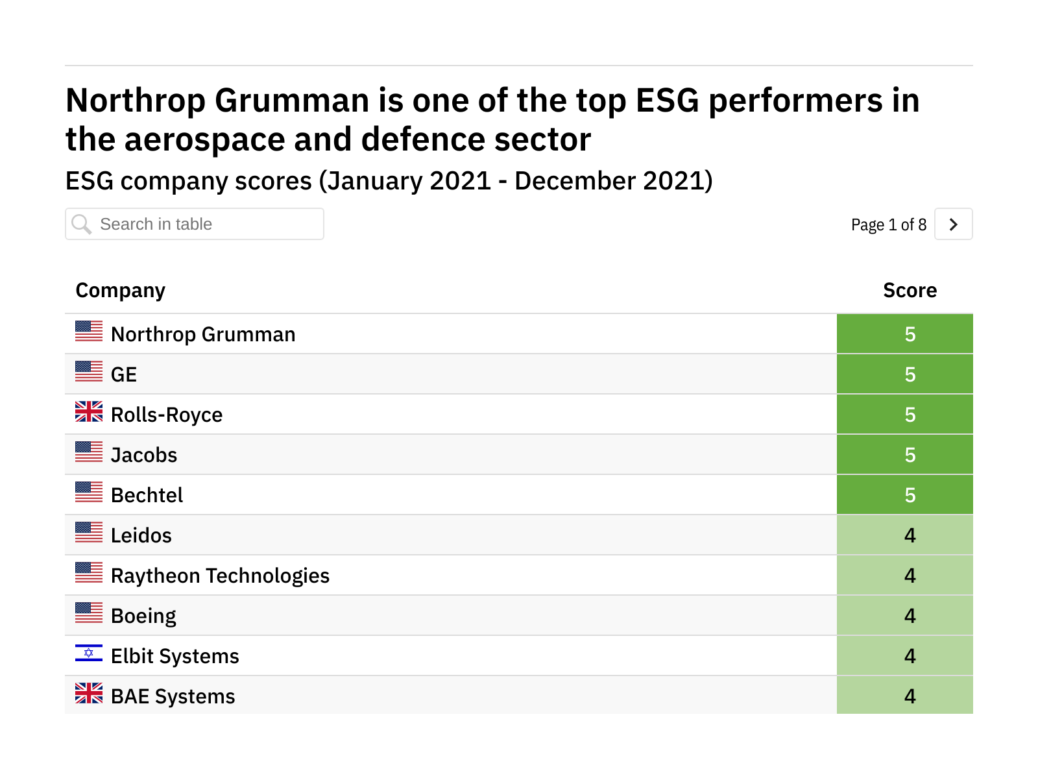

Northrop Grumman and GE are among the many corporations greatest positioned to benefit from future ESG disruption within the aerospace and defence business, our evaluation exhibits.

The evaluation comes from GlobalData’s Thematic Analysis ecosystem, which ranks corporations on a scale of 1 to 5 based mostly on their chance to deal with challenges like ESG and emerge as long-term winners of the aerospace and defence sector.

In line with our evaluation, Northrop Grumman, GE, Rolls-Royce, Jacobs and Bechtel are the businesses greatest positioned to profit from investments in ESG, all of them recording scores of 5 out of 5 in GlobalData’s Protection Thematic Scorecard.

The desk under exhibits how GlobalData analysts scored the most important corporations within the aerospace and defence business on their ESG efficiency, in addition to the variety of new ESG jobs, offers, patents and mentions in firm studies since January 2021.

The ultimate column within the desk represents the general rating given to that firm in relation to their present ESG place relative to their friends. A rating of 5 signifies that an organization is a dominant participant on this house, whereas corporations that rating lower than three are weak to being left behind. These will be learn pretty straightforwardly.

The opposite datapoints within the desk are extra nuanced, showcasing current ESG funding throughout a spread of areas over the previous 12 months. These metrics give a sign of whether or not ESG is on the high of executives’ minds now, however excessive numbers in these fields are simply as more likely to signify determined makes an attempt to catch-up as they’re real energy in ESG.

For instance, a excessive variety of mentions of ESG in quarterly firm filings might point out both the corporate is reaping the rewards of earlier investments, or it wants to take a position extra to meet up with the remainder of the business. Equally, a excessive variety of offers might point out that an organization is dominating the market, or that it’s utilizing mergers and acquisitions to fill in gaps in its providing.

This text relies on GlobalData analysis figures as of 21 January 2022. For extra up-to-date figures, verify the GlobalData web site.

[ad_2]

Supply hyperlink